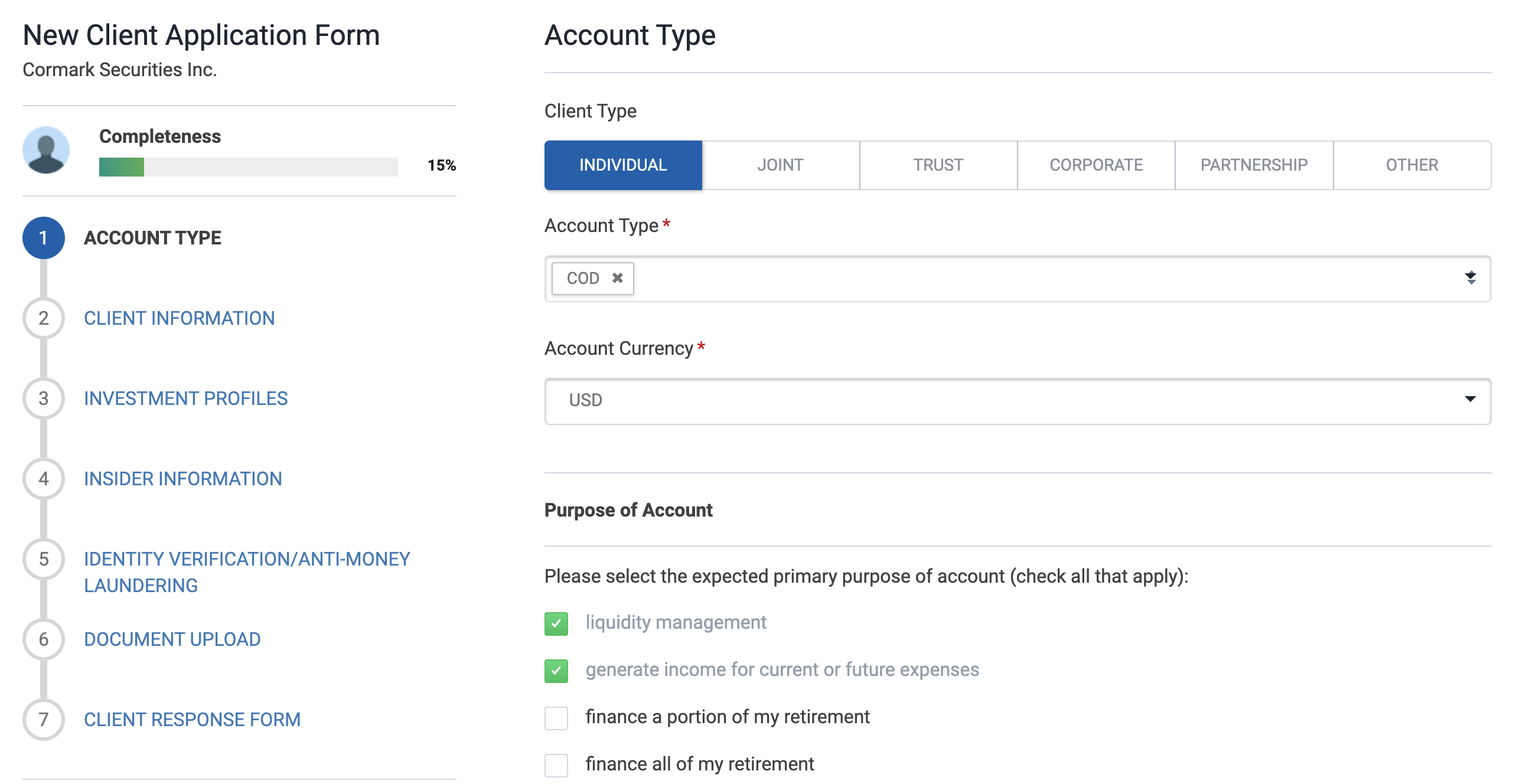

When creating accounts, investors can select different account types including Individual, Corporate, Trust, and Joint to accommodate both retail and institutional investors.

DealFlow Accounts will intelligently update form fields and tax documentation accordingly, making the onboarding process intuitive and highly automated for investors.

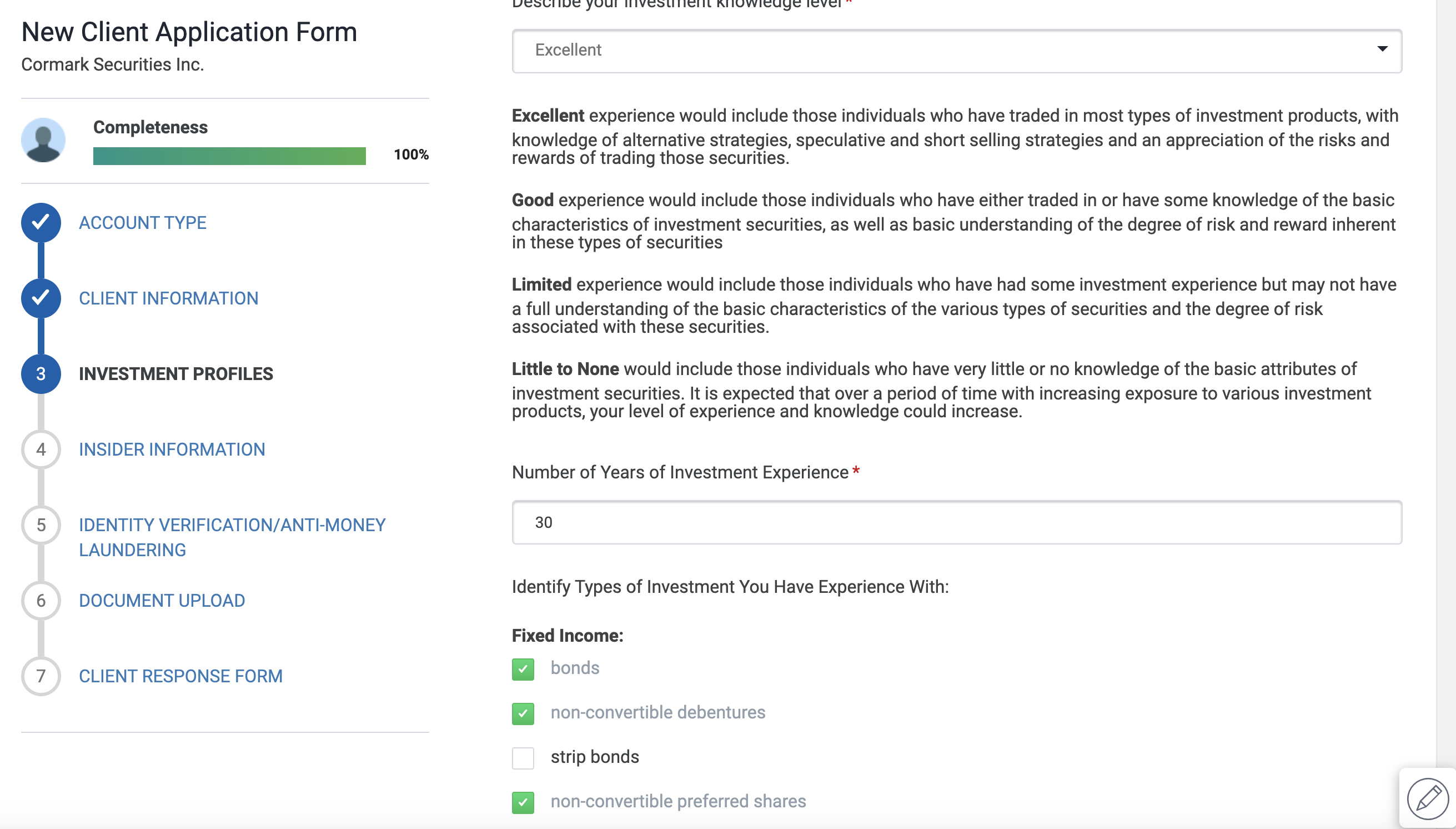

Digital KYC tools enable investors to instantly navigate identity and verification processes while meeting stringent compliance regulations.

Investors receive an invitation automatically to complete KYC renewals in alignment with compliance policies.

Intuitive smart forms simplify the investor onboarding process and result in error-free documentation.

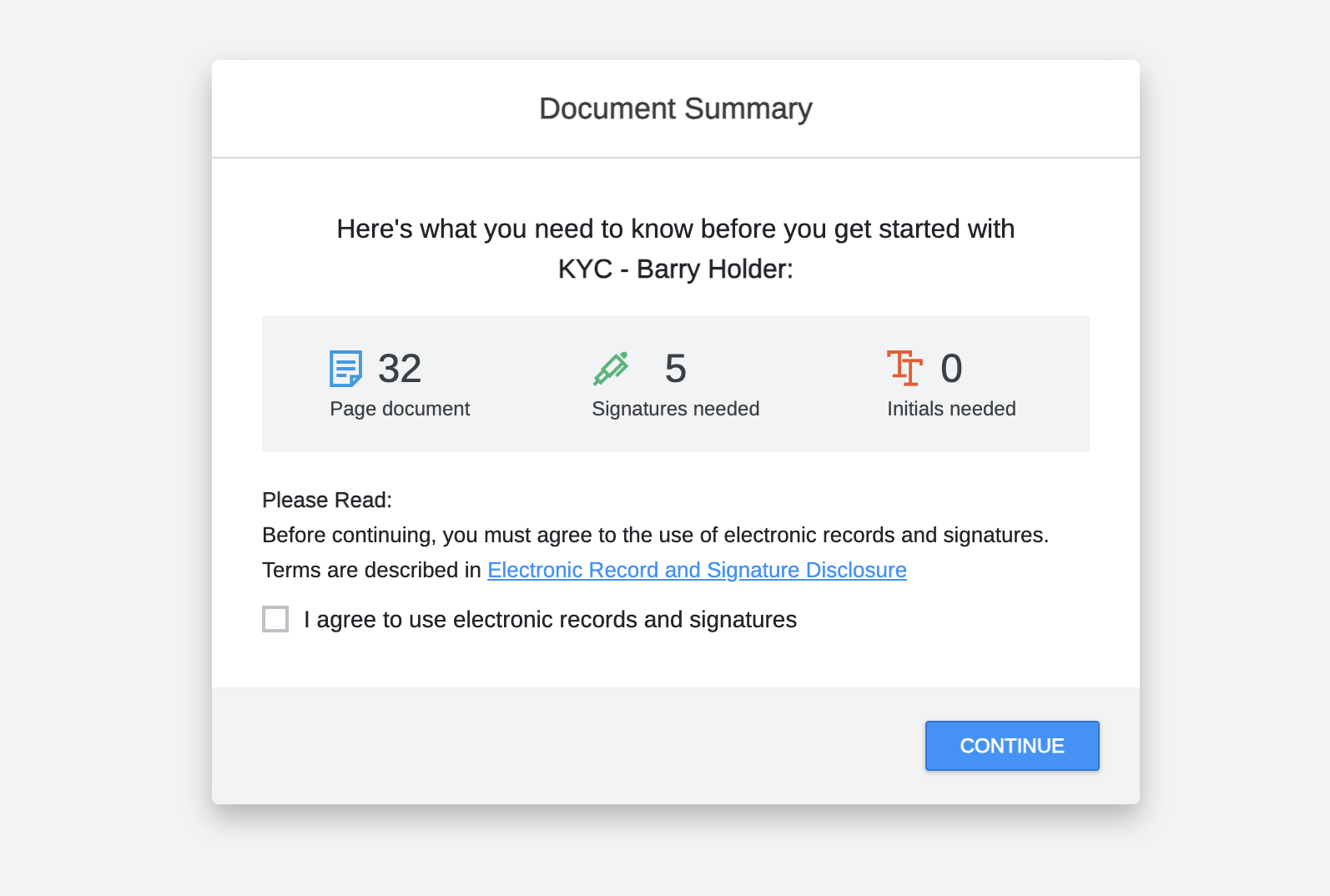

Investors receive a unique package of documents auto-populated with their details for electronic signature, ensuring the relationship with investors starts well.

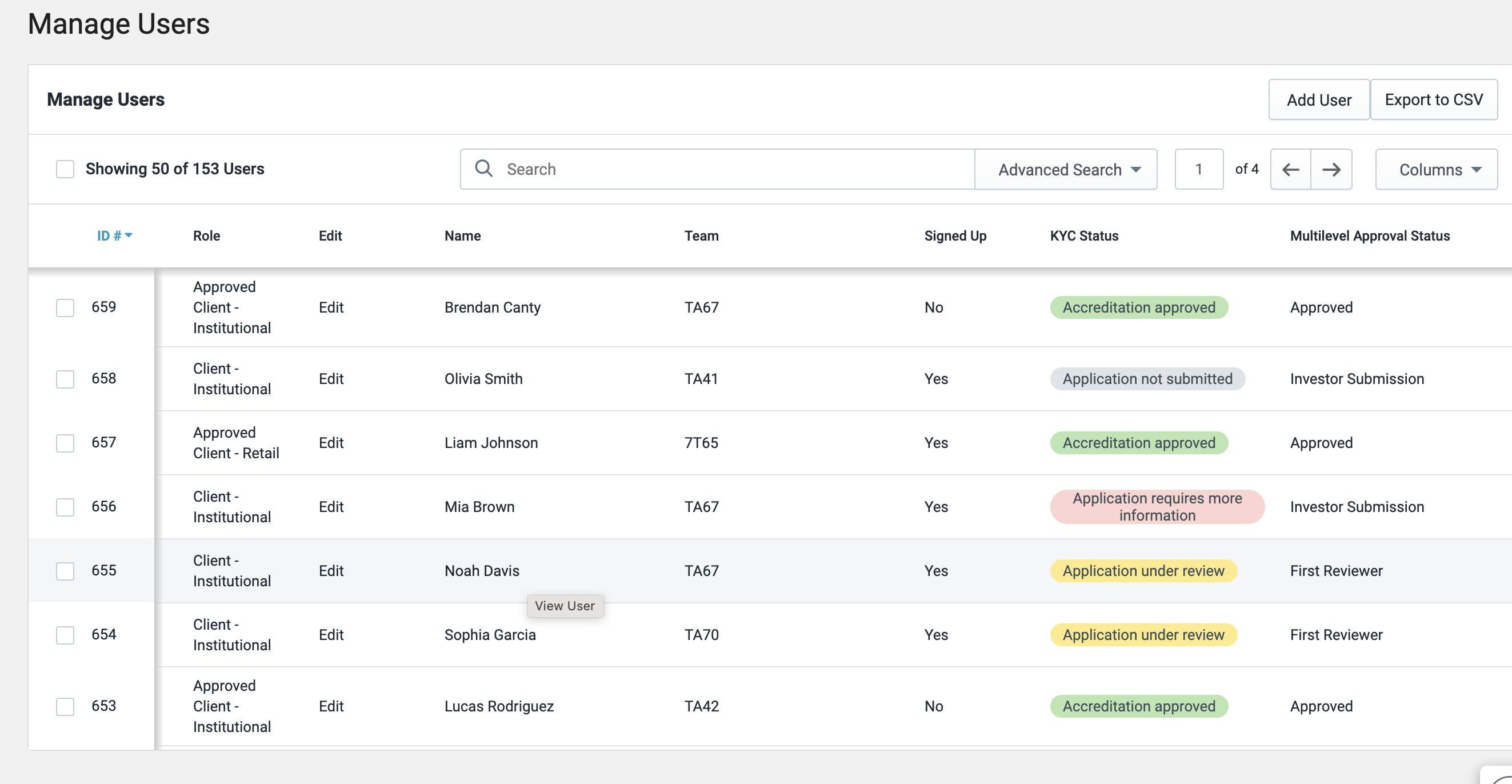

Real-time dashboards that illustrate investors' progress through the opening process ensure new account teams can monitor investor onboarding.

This visibility enables teams to follow investor accreditation progress and expedite reviews and approvals.

Download the DealFlow Accounts product guide now to understand more about key benefits, features and functionality.

Read about why Cormark Securities chose DealFlow Accounts for their investor onboard solution.

Katipult DealFlow is changing the way that capital is raised with efficient and streamlined workflows which enable deals to close in days, not weeks or months.

Get answers to your unique questions, see the investment platform in action and discover why Katipult DealFlow is the right capital markets technology for your business.

900-903 8th Ave SW

Calgary, AB T2P 0P7